Superannuation Investment Option

Salaam Growth

An investment option for members seeking long-term growth assets combined with significant exposure to income-producing assets.

| Description |

Invests across a diversified range of Islamic assets, including Australian and International Equities, Unlisted Assets, Alternative Assets, Islamic Cash and Islamic Fixed Income with an emphasis on long-term growth assets combined with a significant exposure to income-producing assets. This option is suitable for investors seeking mainly capital growth and investing for the long term. |

| Investment objective |

To achieve an average net return (after investment fees and tax) equal to or better than inflation plus 3% p.a. over rolling 10-year periods |

| Suggested minimum timeframe | Minimum 10 years |

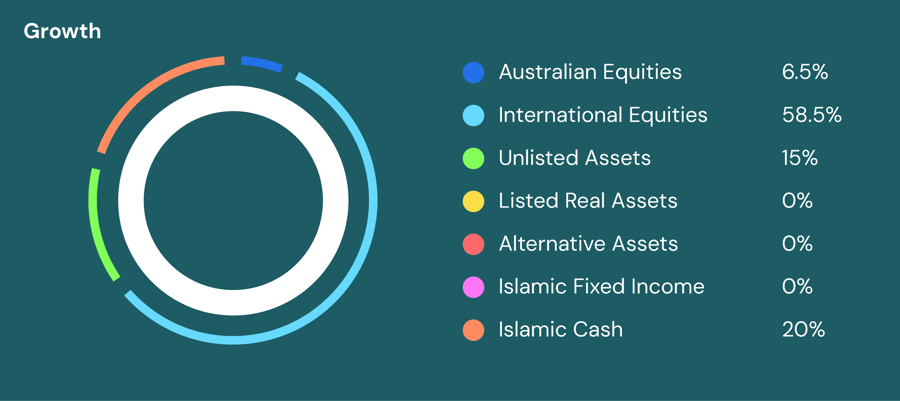

| Target allocation 1 | 80%-100% Growth Assets 0%-20% Defensive Assets |

| Long term risk level | Low |

| Administrative fees and costs | 0.23% of your account balance per year plus $60 per year |

| Investment fees & costs (estimates only) 2 | 1.34% of assets p.a. |

| Transaction costs (estimates only) | 0.03% of assets p.a. |

1 Target allocation is a strategic benchmark only. Actual allocations may vary within the described ranges.

2 Investment fees and costs shown here are forward-looking estimates applicable from the date of preparation of this PDS and do not include performance fees as performance fees are not applicable. Refer to the ‘Additional Explanation of Fees and Costs’ in the Salaam superannuation Investment Guide.